The outbreak of COVID-19 has a terrible effect on many companies in Thailand. Many Thai companies are experiencing a problem of cash flow and liquidity in this scenario. In some cases employers are considering to restructure the companies and number of employees in order to protect their businesses. When the companies in Thailand want to terminate the employee, they have to comply with the law of Civil and Commercial Code and Labour Protection Act B.E. 2541.

Under the circumstance of COVID-19, many companies are approaching H&P in Bangkok to provide feasible legal solutions. The fact is that even if It is not a force majeure, the company can bring some costs down.

By Law this circumstance is necessary for an employer to temporarily cease the business operations, wholly or partly, for whatever cause of significance, affecting their business activities to the extent that the employer is unable to carry on with their normal operations.

By keeping the employee in the company under this situation, the employer can pay wages to an employee in the amount of not less than 75 percent of wages for a working day that the employee was receiving before the cessation of business operation for the entire period in which the employer does not require the employee to work. In order to to this, the employer has to give in advance a written notice to the employee and the Labour Officer for a period of not less than three working days before the date of business cessation pursuant Section 75 of Labour Protection Act B.E. 2541.

Regarding the termination of employment in Thailand, in general the Civil and Comercial Code section 583 allows the employer can dismiss the employee without notice or compensation, if the employee willfully disobeys or habitually neglects the lawful commands of his employer, absents himself for services, is guilty of gross misconduct, or otherwise acts in a manner incompatible with the due and faithful discharge of his duty.

In addition to section 119 of the Labour Protection Act, B.E. 2541 append the right of the employer to terminate the employee without notice or compensation or severance pay by any following of this reason, performing his/her duty dishonestly, intentionally committing a criminal offense against the employer or willfully causing damage to the employer, committing negligent acts causing serious damage to the employer, violating work regulations, absenting from duty without justifiable reason for three consecutive working days, being sentenced to imprisonment by a final court judgment but if the offense was committed with negligence or was a petty offense, it must have caused damage to the employer.

Without the reasons abovementioned the termination of employment within the framework of COVID-19 must follow these obligations and comply:

1. The employer can terminate the employment contract by giving advance notice in writen to the employee on or before the due date of wage payment in order for the termination to take effect on the following next salary payment

If the employer wants to dismiss the employee immediately the employer may pay wages in an amount to be paid up to the time the termination of the contract of employment will be effective as specified in the notice pursuant to section 17, section 17/1 of The Labour Protection Act B.E. 2541

Case example The employer pays wages every month the 29th. If the employer wants to terminate the employment contract and give advance notice in writing to the employee on or before 29 March. The terminate the employment contract will be effective on 29 April. The employer has to pay wages in March and April.

If the employer wants to dismiss on 29th of March immediately. It can be done by the employer to pay wages on 29 April.

In this example, if the employer gives advance notice to the employee after 29 March. It will effective to be a notice on 29 April and employment will terminate on 29 May. The employer has to pay a wage until 29 May.

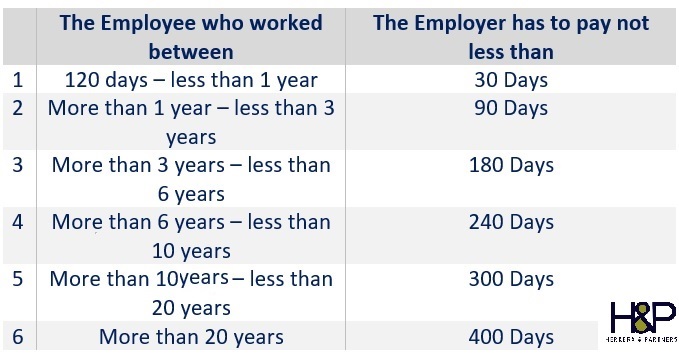

2. The termination of employment based on the period of time working for the employer has to comply The Labour Protection Act, B.E. 2541. The employer has to pay severance to an employee whose employment is terminated, as follow:

The Employee who worked between The Employer has to pay not less than:

3. The employer has to pay the employee the wages for the employee annual vacation for the year in which the employment was terminated, in proportion to the number of days of annual vacation to which the employee is entitled pursuant to section 30, section 67 of The Labour Protection Act, B.E. 2541.

4 The employer has to pay wage, overtime pay, holiday pay, and holiday overtime pay to which the employee is entitled until the employment contract was terminated.

Finally H&P lawyers in Thailand want to point out that in virtue of Section 75 Labor Protection Act: “When it is necessary for an Employer for whatever cause other than a force majeure which affects his/her business and causes the Employer incapable to operate his or her business as normal so as to temporarily suspend the business in whole or in part, the Employer shall pay wages to an employee in the amount of not less than seventy-five percent of wages of working days received by the employee before the suspension of business for the entire period which the Employer does not require the employee to work. The Employer shall give written notice to the employee and the Labor Inspector in advance prior to the date of suspension of business under paragraph one for not less than 3 working days”.

In order to consider that a pandemic affected to business operation, our lawyers need to know more details about each specific case such as how the business of the company was affected directly or indirectly and if it is a real cause or not for the employer to shut down the business.

In case that the business was directly affected by the pandemic and the employer have sent prior notice to employees at least 3 days in advance, the employer was not entitled to pay 75% of salary due to the FORCE MAJEURE.

In case that the business was not directly affected by the pandemic, this is not considered as FORCE MAJEURE, the employer shall pay the salary as usual.

Moreover, what we have to consider furthermore, is that where the industry/business is located in Thailand. The location or area is relevant as there might be specific regulations about this outbreak.

If you need legal advice on restructuring companies in Thailand and Labor Law, please contact our Bangkok lawyers at [email protected]